Personal Contract Purchase (PCP) agreements are one of the most popular ways to finance a car in the UK. However, many consumers may have been mis-sold these agreements, resulting in them paying more than they should have. If you took out a PCP deal and suspect you were overcharged due to hidden commissions, this guide will help you understand your rights and how to reclaim the money you may be owed.

What is a PCP Agreement?

A Personal Contract Purchase (PCP) is a type of car finance where you make monthly payments over a set period, with the option to buy the car outright at the end by making a large final payment, known as a “balloon payment.” If you choose not to buy the car, you can return it to the dealer or trade it in for a new one under a new PCP agreement.

PCP agreements are attractive because they often offer lower monthly payments compared to other types of car finance. However, these agreements can be complex, and not all consumers fully understand the terms, especially when it comes to interest rates and commissions.

How Were PCP Deals Mis-Sold?

Many PCP agreements were mis-sold through discretionary commission arrangements (DCAs). In these cases, brokers or car dealers increased the interest rates on the finance deal to earn a higher commission, without disclosing this practice to the customer. As a result, you may have been overcharged without even realising it.

Common signs that your PCP deal may have been mis-sold include:

- Lack of Transparency: You were not informed that the interest rate was negotiable or that it included a commission for the broker or dealer.

- Confusion Over Terms: You were not given clear information about the terms of the agreement, including the final balloon payment.

- Pressure to Accept Terms: You felt pressured to accept the deal without fully understanding the costs involved.

If any of these situations sound familiar, you may have a valid claim to recover the extra costs you were unfairly charged.

How to Determine if You Have a PCP Claim

To determine if you have a PCP claim, start by reviewing your car finance agreement. Look for any mention of commissions or if the interest rate seems unusually high. If you don’t have the original paperwork, don’t worry—our team can help you retrieve the necessary information from your lender.

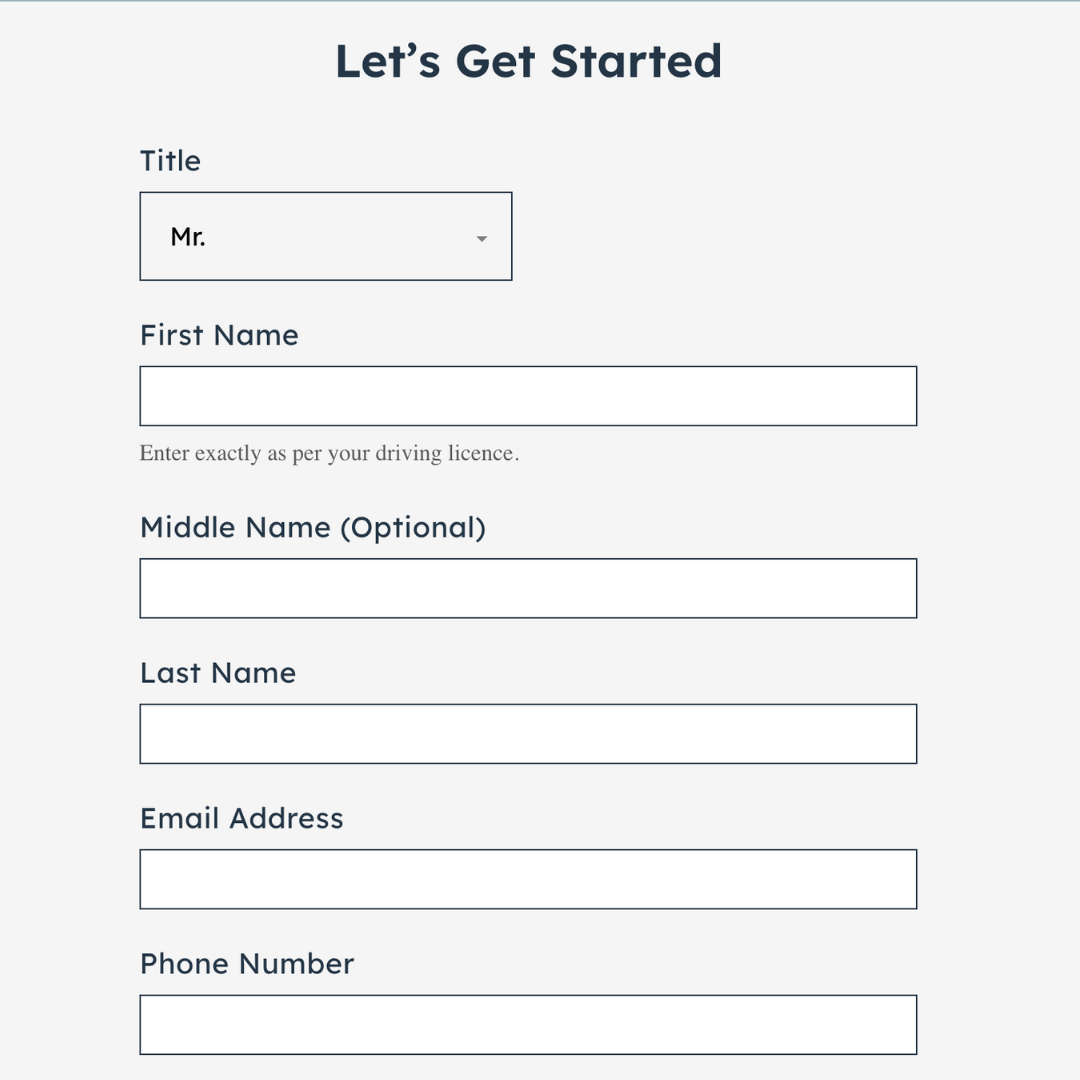

You can also use our free car finance check tool to quickly assess whether your PCP deal was mis-sold. This tool will guide you through the process of identifying key details that indicate a potential claim.

Steps to Reclaim Your Money

If you believe you were mis-sold your PCP agreement, it’s crucial to act quickly to start the reclaim process. Here’s how you can begin:

Gather Documentation:

Collect any documents related to your PCP agreement, including the contract, payment records, and any communication with the dealer or lender.

Check for Mis-Selling Indicators:

Use our PCP claims guide to identify common signs of mis-selling in your agreement.

File a Complaint:

Submit a complaint to your car finance provider, outlining the reasons you believe the agreement was mis-sold. Our How to File a Car Finance Claim guide provides a detailed step-by-step process to help you.

Seek Professional Help:

Consider consulting with a finance claims expert to ensure your claim is handled correctly. Our company specialises in navigating complex claims, ensuring you have the best chance of recovering the money you’re owed.

What Compensation Can You Expect?

The amount of compensation you could receive depends on the specifics of your case. In most successful PCP claims, consumers have been able to reclaim the difference between the interest rate they were charged and the rate they should have been offered without the hidden commission.

For more detailed information on potential compensation, visit our Car Finance Compensation: What to Expect page, where we explain how compensation is calculated and what you can anticipate.

Conclusion: Act Now to Reclaim What’s Yours

If you’ve taken out a PCP agreement and believe you may have been mis-sold, don’t wait—act now. With the right support, you could recover a significant amount of money. Start by using our free car finance check to determine your eligibility, and let our team guide you through the reclaim process.

Remember, the longer you wait, the more challenging it may become to file a successful claim. Let us help you reclaim what’s rightfully yours.